Global merger and acquisition (M&A) activity is set to increase in asset management in 2018. Given the rapid growth of this issue in the industry, we’ve been following the actions of institutions more and more closely, and have recently released our white paper on M&A, entitled:

How Asset Managers are using M&A to Strengthen & Diversify

Here are some of the paper’s key takeaways.

A spike in corporate activity

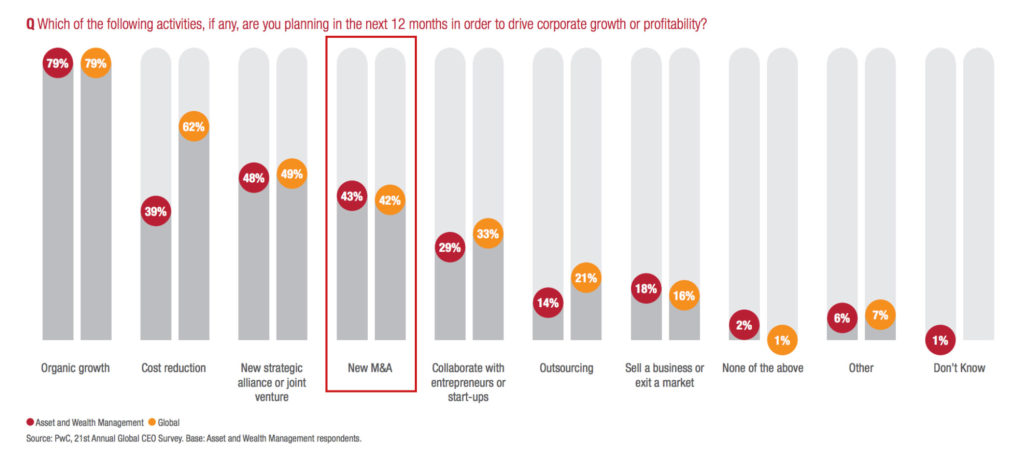

The first quarter of 2018 saw deal values recline, but a survey from PwC found that a large proportion of asset managers are looking to M&A as one factor to increase corporate growth and profitability in the next 12 months:

Regulation worries

One of the assumed main causes for falling profit margins are regulations which have come into effect extremely recently; 83% of asset managers agree that they are concerned with measures that affect the financial industry. Within the European Union, the Markets in Financial Instruments Directive (MiFID II) is the main caveat, with the Department of Labor (DOL) Fiduciary Rule causing regulatory panic in the US.

The diversification of product offerings, scaling, and market reach can be hit by such repercussions, hence providing another motivation for asset managers to look to M&A to best advance on their own capabilities. For instance, investment managers may look to acquire capabilities in popular asset classes or sectors including real estate of private equity, Baber Din (partner at Deloitte) claims.

The roles of the US and Europe

Both managers in European countries and in the US will look to M&A opportunities abroad.

The UK, for instance, will hope to increase scale in the United States using M&A, whilst it remains an attractive M&A destination for US managers post-Brexit, as do countries in the European market.

Technology as a boost

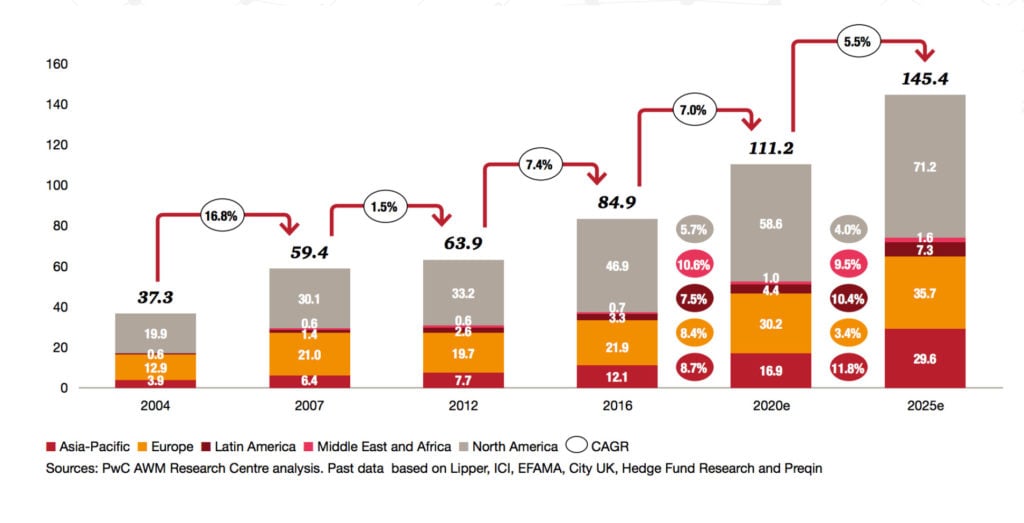

Thankfully for the asset management sector, PwC also predicts that global AUM will almost double in value from 2016 by 2025: Whilst active managers will (assumedly) account for around 60% of this global AUM figure, they will have to adapt to remain competitive, by becoming more efficient and entrepreneurial.

Whilst active managers will (assumedly) account for around 60% of this global AUM figure, they will have to adapt to remain competitive, by becoming more efficient and entrepreneurial.

The market is changing drastically, with passively managed funds (including ETFs) and technologies such as artificial intelligence, big data and blockchain all vying for action on the playing field. Taking the opportunity to acquire new technologies could determine the future winners within the industry. We have already seen such examples as Invesco’s acquisition of ETF providers Source and Guggenheim ETF, for instance.

Scaling is key

Due to rising costs from regulation, the ability to scale remains paramount. Din states that there is a large proportion of attractive firms of all sizes to be acquired for this goal to be possible, also to assist with increased competition and price transparency issues.

Large traditional managers have found that merging at a sufficient scale is difficult to overturn falling margins. Elsewhere, merging fund managers have faced problems including culture clash, the departure of key employees and difficulty to deliver benefits to shareholders.

Models for integration and scaling therefore need to be pre-planned for an acquisition to succeed in leveraging data and technology.

If you have any further thoughts on M&A within the asset management space, please feel free to comment below or tweet us @kurtosys.

White Paper: How Asset Managers are using M&A to Strengthen & Diversify

Based on recent findings and events, global asset managers are set to keep using mergers and acquisitions to strengthen and diversify. We take a look at the current state of M&A, including motivations, market trends and margin erosion.

Based on recent findings and events, global asset managers are set to keep using mergers and acquisitions to strengthen and diversify. We take a look at the current state of M&A, including motivations, market trends and margin erosion.