“Customisation is no longer a ‘nice to have’ ” commented Patrick McKenna, Chief Commercial Officer at Kurtosys, after analysing the results of our latest survey.

It’s clear that asset owners expect customisation throughout their investor journey, and there is still room for improvement in the industry. While firms are taking steps to adapt to digital advancements and enhance the client experience, asset owners’ expectations continue to evolve – making automation more essential than ever.

In partnership with independent research agency Adox, we surveyed 65 investment managers to understand their priorities around customisation and how they use and distribute data for client reporting. Our analysis uncovered some compelling insights.

Report customisation

Tailoring reports to individual client needs is a sign of true client focus…Visualisations can make complex data digestible and engaging for clients.

CTO – large European asset management firm

Why are only 8% of firms able to provide full customisation to their clients?

From our results, it’s clear that data issues are a common area of concern, as are challenges with output and distribution. Custom calculations are seen as a critical part of reporting, but they rely on accurate data and timely retrieval.

More than two-thirds (78%) experience issues with their data quality and 37% report that their data is received outside of SLA “regularly” or “all the time,” indicating that investment managers still need to get the fundamentals right.

Adding to this, customisation doesn’t come easy. IT teams are frequently called upon to assist with data-based calculations, configurations and template management. In fact, fewer than 50% of respondents say that their client reporting department can handle customisation requests independently.

The Kurtosys platform supports seamless integration – from data ingestion to advanced configuration tools and automated workflows – making customisation easier than ever. Read more here.

Reporting and data

Data consistency and accuracy are essential to provide customised reports. To achieve this, many asset managers are making the move toward cloud data warehouse solutions. From Snowflake to Databricks, 21% have already adopted new warehousing technologies, and over 30% report a significant improvement in the quality of their reporting.

Despite these advancements, major data issues persist, with only 22% of firms exempt from these challenges month after month.

Communication and automation

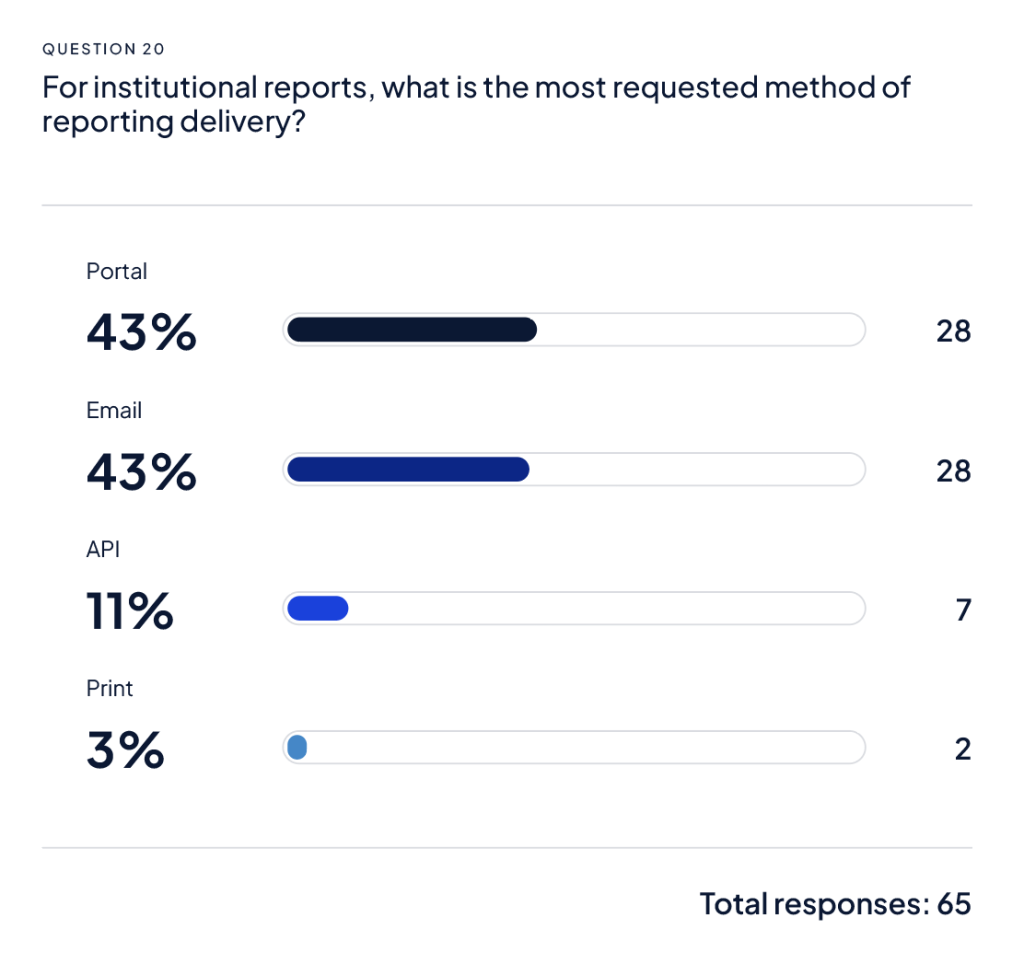

A multi-channel communication approach is considered best practice, according to our survey. While email may seem outdated to some, when combined portals or other digital tools, it remains a valuable option. Asset owners appreciate the flexibility of receiving their reports in a specific format that suits their unique needs. In fact, 43% would like to receive their reports via email, while another 43% want to view them in a portal.

Interestingly, 14% of asset managers still compile their email reports manually, and only 32% are fully automated.

Flexibility is key to client distribution, and the speed at which firms adapt to clients’ needs can make or break the client experience.

Clear, concise, and timely reports are the bedrock of client trust.

CTO – US based large investment manager

Reporting inaccuracies can have a significant impact on client trust and compliance. It’s becoming clear that robust data checks and automation are the way forward. Integrating business rules into reporting workflows helps ensure consistent and reliable output.

Inline health checks can be tailored to fit specific requirements using the system’s interface or APIs. Learn more here.

Our email distribution platform allows you to build, schedule and send emails at scale. Paired with our portal solution, you have a winning combination. Learn more here.

Providing exceptional digital client experiences throughout the entire investor lifecycle remains a challenge for many respondents. While some asset managers are future-proofing their data solutions and communication stack, others still rely on manual methods.

Kurtosys aims to guide clients through the lifecycle, delivering solutions that solve common challenges along the way. Reach out to us to discuss our solutions.

Download the white paper

About the authors of our survey

Patrick oversees the commercial and product related activities at Kurtosys, a leading solutions provider of client reporting, client portals and multi-region websites for the investment management industry. Having spent the last twenty years working on both the buy and sell side, Patrick has a wealth of experience in most areas of investment technology, ranging from client reporting and digital through to trading and risk. For the last ten years he has stewarded the build out of the Kurtosys Cloud platform and is a keen proponent of the modernisation of the IM tech stack via the cloud, a topic he speaks about regularly at industry events.

Gert Raeves is the founder and lead Research Director at Adox Research. With over 20 years of experience in banking, asset management and technology at firms including JP Morgan, SWIFT, and CEB TowerGroup, he covers strategic issues facing buy-side and sell-side firms globally and advises clients on strategy, regulation, technology and product development.