In the fast-evolving, or should I say ‘chaotic’ world that we operate in, staying ahead means continuously innovating, adapting, and responding to shifting client expectations. Our recent Kurtosys client day brought together industry leaders, forward-thinkers, and practitioners to explore how asset managers can harness data, refine customer experience (CX), and differentiate their brands in today’s competitive landscape.

As we find ourselves simultaneously tackling the complexities of regulatory compliance, strategising on data management, or striving to create a standout client experience, the insights shared at our event offer actionable takeaways for teams looking to build resilience and drive growth. Here, we recap key themes that emerged, from macroeconomic perspectives to technology’s role in transforming the client journey, offering you a blueprint for staying relevant in the years ahead.

Setting the scene with a global macroeconomic perspective

Alexander Dryden provided a compelling macroeconomic outlook, using his unique approach to delivering insights through the art of storytelling, he likened central banks’ synchronised efforts to a cycling peloton navigating post-COVID recovery. With global interest rate cuts, fixed-income markets are rebounding, offering potential returns of 6-7%. Meanwhile, China faces a deflationary challenge due to debt and demographic pressures, leading to government stimulus that could also benefit emerging markets. In the West, debt presents a strategic dilemma: policymakers must either spur growth or cut spending, likely increasing volatility in the near term.

Data strategies within asset management fireside chat

Simon Swords & Patrick McKenna discussed data strategy in asset management, highlighting that effective data management is crucial for competitive advantage but often mishandled by treating data as purely technical rather than as a core business asset. They emphasised that asset managers should structure data roles to align with business needs, ideally reporting to the COO instead of the CTO, to better integrate operational focus. Fundipedia, positioned as a “data well” for investment firms, helps maintain data boundaries, preventing data lakes from becoming “data swamps.” They also cautioned against rushing into AI without first establishing strong data quality, recommending gradual AI integration like chatbots to gain insights. Swords concluded that a thoughtful, structured data strategy is essential for compliance, client satisfaction, and future AI readiness.

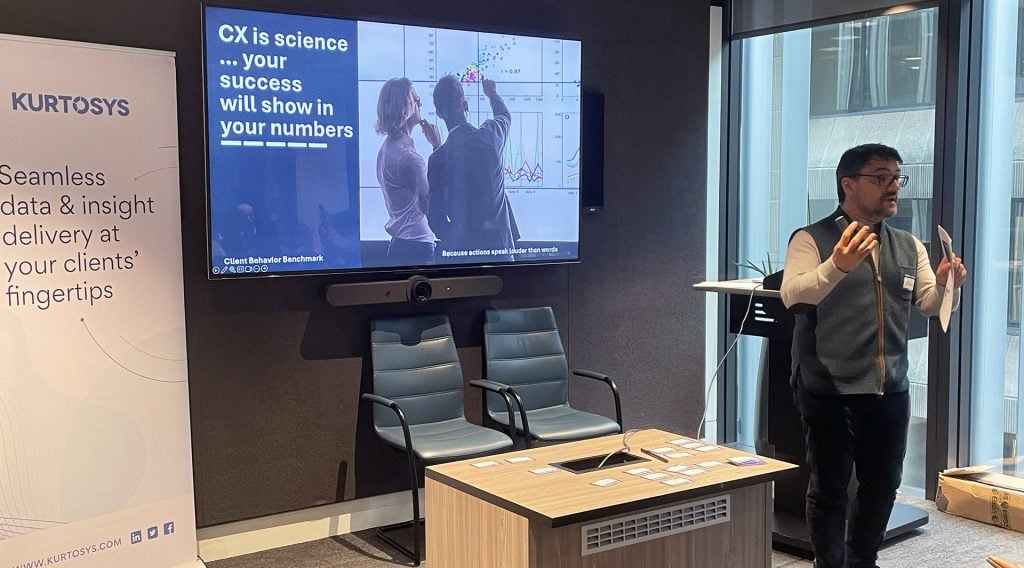

Customer experience (CX) as a differentiator

Adam Grainger emphasised CX as both an art and a science, measuring impact through client behaviour, time, and engagement. In an oversupplied market, performance and price don’t drive differentiation, but CX does. Control your CX, identify superfans, and track any customer journey “leakages” through end-to-end scorecards.

Industry resilience and adaptability

Gary Paulin highlighted the need for resilience amid asset volatility and market chaos. Consolidating vendor networks and fostering a culture of stability are key. Close collaboration between ops and investment teams drives innovation and stability, while financial resilience, particularly cash on hand, remains critical during times of high uncertainty.

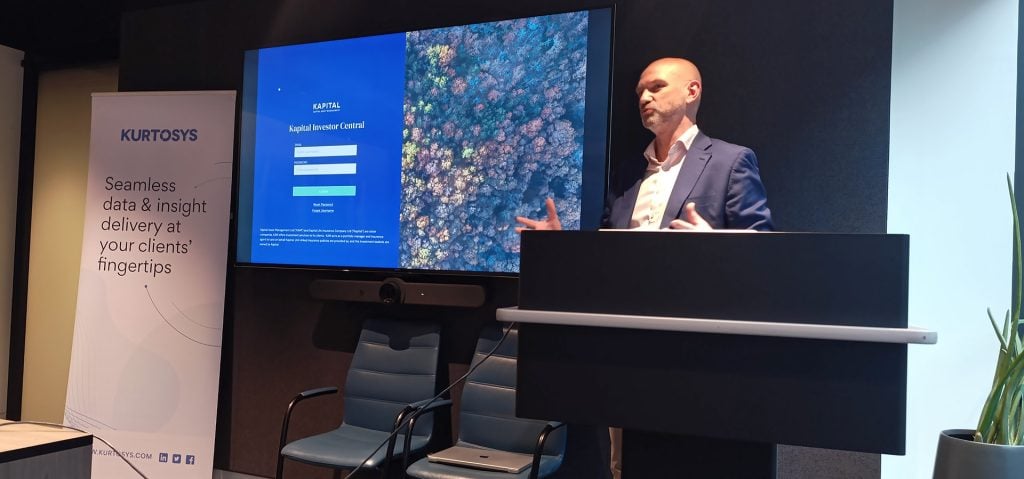

Investor experience and self-service portals

Patrick McKenna showcased how to lift the investor experience with self-serve portals for data access, transaction searches, and asset allocation. Features like password-less login, access to persona-relevant thought leadership content, and Salesforce integration support a seamless user experience, allowing investors to access tailored resources. Even early on during the prospecting phase, a portal can provide an easy entry via a gated experience with just an email address.

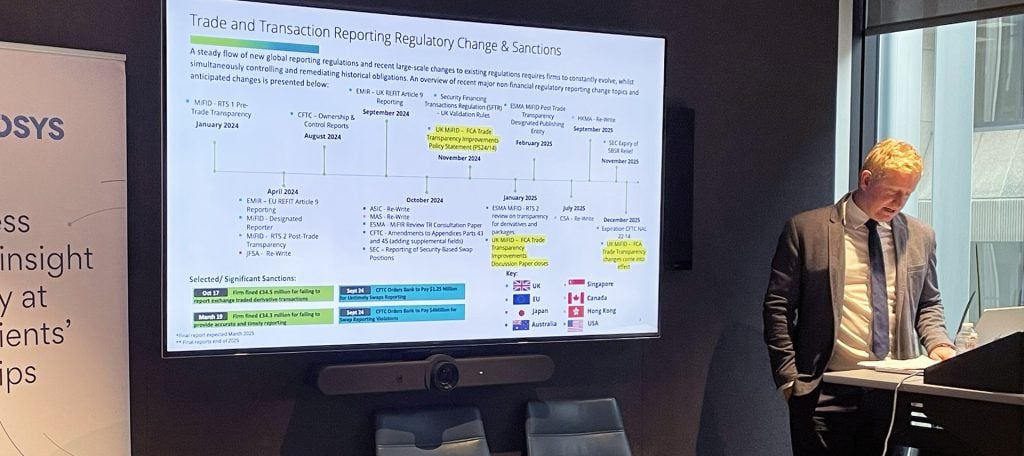

Regulatory compliance and proactivity

Jon Warwick from Deloitte outlined the increasing regulatory demands in asset management. Transparency and proactive compliance are essential to avoid fines, especially with evolving MiFiD and SFTR regulations. Strong governance and comprehensive reporting frameworks can reduce risk and ensure regulatory alignment.

Humans with agents drive customer success together

Avril Couper from Salesforce explains that technology is moving faster than ever, with the wave has moved past predictive, to generative and towards autonomous. We’re experiencing an AI revolution with 82% of companies planning to integrate autonomous agents in 1 – 3 years and 64% of companies expect autonomous agents to relieve humans of repetitive tasks.

Latest survey on what users value most in reporting and digital software

Neil Thornburn shared our latest survey with data from over 60 investment managers. Results show that while more than two thirds (68%) of asset owners require customised reports, it is a big challenge for asset managers to deliver on these expectations. With 75% of respondents experiencing issues with their data quality and 55% of firms needing significant IT support to customise. The report, due to be published early in 2025 outlines data, output and distribution strategies to empower asset managers to deliver high-volume, accurate, customised reports on time.

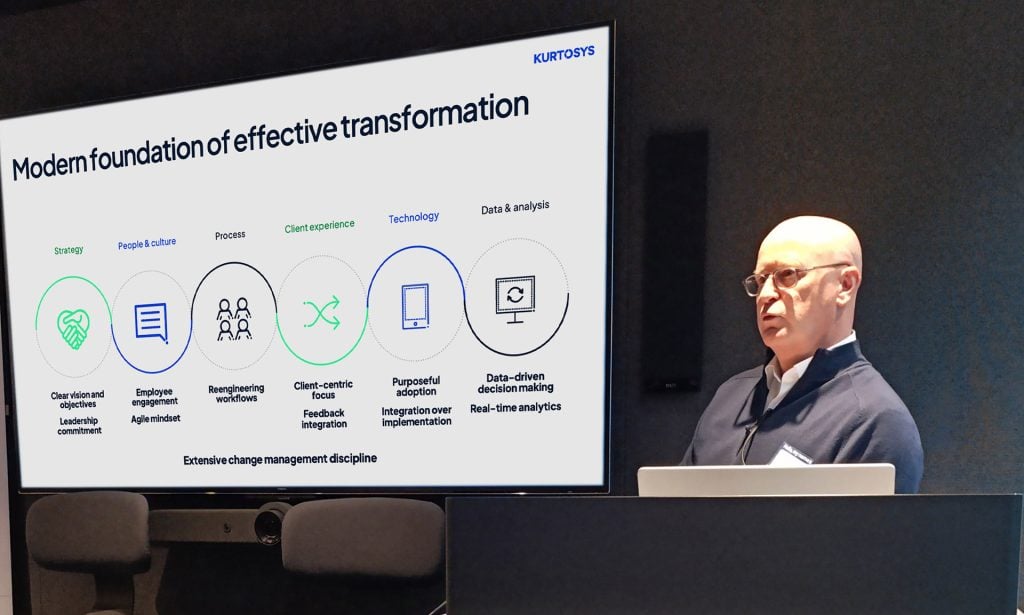

Empowering Transformation and Innovation

Mark Warren advocates for a balanced approach in transformation projects, focusing on empowering teams rather than controlling them. Successful transformations combine strategy with data-driven decisions and ensure that both internal and external messaging are aligned.

Differentiation of you: CX panel discussion

Michelle Wright expertly moderating this engaging panel discussion, featuring Alexander Dryden, Adam Grainger and Brodie Neader, who shared valuable insights into CX differentiation in investment management emphasised the power of clear, relatable messaging, driven by storytelling over technical jargon. Firms are encouraged to focus on memorable experiences, using data to define and measure success while benchmarking against both past performance and peers. A consistent internal and external voice was seen as crucial, creating a unified experience like a synchronised rowing team. With younger investors expecting more self-serve options, the panel also reiterated that clean data is essential for effective AI in CX.

Empowering Teams through AI Adoption

Sunil Odedra explains AI tools are in their infancy, and with this in mind we foster a culture of playfulness and experimentation. Kurtosys achieved broad AI adoption across teams in 2024, focusing on productivity, independence, and innovation. Key initiatives include capturing existing tool use, suggesting new applications, providing budgets for experimentation, and sharing success stories. Core use case included ElevenLabs for voiceovers, Gong for CRM notes, GitHub Copilot for coding, and ChatGPT for QA. Teams have automated more workflows, like converting meeting notes into JIRA tickets with MS Copilot, and GitHub Copilot helps developers accelerate during deadlines. We’re also exploring AI in document analysis and error detection, supporting investment management’s specific needs.

Examples of AI generated images that highlight typical errors that occur with human subjects and when tasked to include text elements.

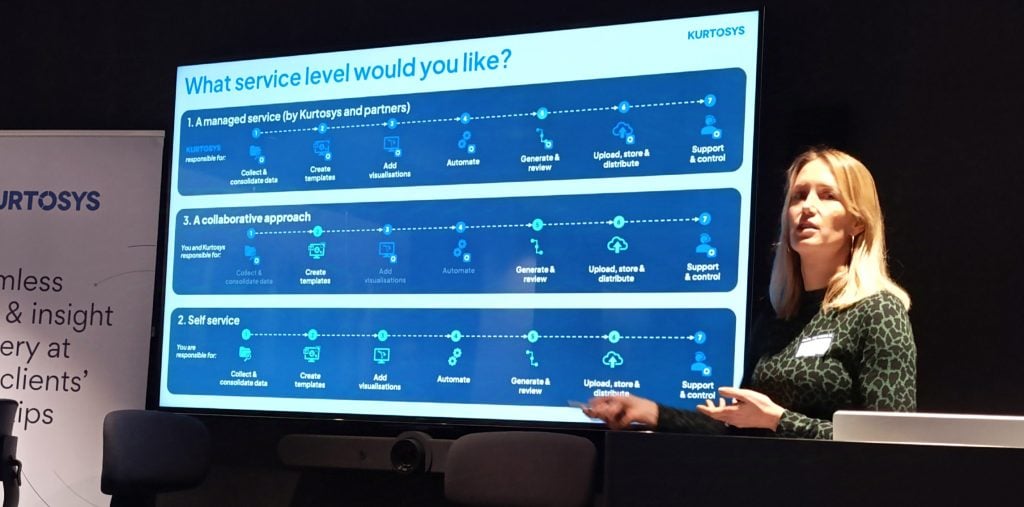

It’s simple, really

Michelle Wright, shared the strategic product vision for 2025, emphasizing a commitment to simplicity and enhancing usability. She outlined how our product works seamlessly in just seven steps, whether you’re running reports, updating your website, or managing your portal. Michelle shared how the Kurtosys platform is tailored to support a variety of user personas, complemented by robust training and client support structures. Additionally, she highlighted the range of services Kurtosys offers, from managed and collaborative solutions to self-service options. The focus remains firmly on empowering clients with a platform that is intuitive, flexible, and supported by dedicated resources.

Technology adoption in HR

Lee Watts explains that technologies and automation allow HR departments to focus on both tactical and strategic, high-value tasks. It fuels success with smarter decision-making, enhanced efficiency and focus, predictive analytics and future readiness, scalability and agility and a competitive advantage through innovation. Adopting generative AI helps to enhance personalised learning and employee engagement.

Our CEO, Lee Godfrey, closed off the day by thanking everyone who made the Kurtosys Client Day a success—from our speakers who shared their valuable insights to all the attendees who brought energy, curiosity, and perspective. For those unable to join, we hope these takeaways give you a glimpse into the conversations shaping our industry’s future.