Money doesn’t grow on trees, but in the 1620s in the Netherlands, it blossomed from the ground in the form of brightly colored bulbs. This may sound like something out of a fairytale, but tulips reached immense popularity during the Dutch Golden Age and actually created the world’s first economic bubble. The overpriced tulips had a whopping twenty-fold increase in value in just one month! It goes without saying that the prices were not an accurate reflection of the value of a single tulip. Their value began to dive and people began to panic. Inevitably, the market crashed and no one was left unharmed from it.

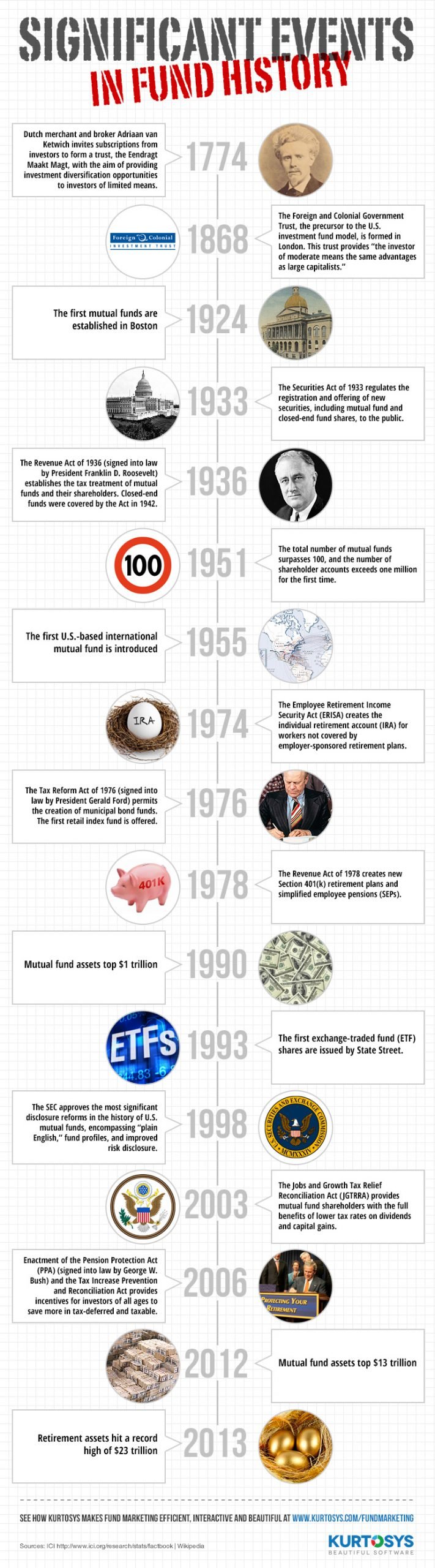

The tulip craze’s rise and fall was one of the first significant events in fund history. There are many others that followed suit. More recently in 1993, State Street issued the world’s first exchange-traded fund (ETF). Today there are over 1,300 different ETFs in the US alone!

The history of funds is a rich one — many important events shape the industry we know today. Referencing ICI’s 2014 Investment Company Factbook: A Review of Trends and Activities in the US Investment Company Industry, we’ve made understanding the most significant events in fund history a little easier with the creation of a visual timeline. We begin with Dutch merchant and broker Adriaan can Ketiwich’s goal of forming a trust — over a hundred years passed the tulips phenomenon — and end with the record high of $23 trillion in retirement assets just last year.