OP Financial Group transforms client experience with its dynamic reporting portal

The challenge

The team at OP Financial Group came to us with a clear brief — improve their digital reporting for sharing portfolio and investment data, and optimise the client experience through an intuitive user journey.

Our design consultants kicked off with a series of research, discovery and design sessions culminating in a clear strategy for the OP client portal. The process included both a review of existing paper reporting as well as client feedback sessions. We then teamed up with OP to create a portal design that visualised the end-to-end user experience.

These designs helped the OP team communicate internally to key stakeholders as well as project teams involved in the roll-out — including the technology and operations team responsible for data provision and workflow. Once designs were signed off (with extensive input from Compliance), and the project had been commissioned, the team progressed to Phase 2, Portal Configuration.

The power of the portal

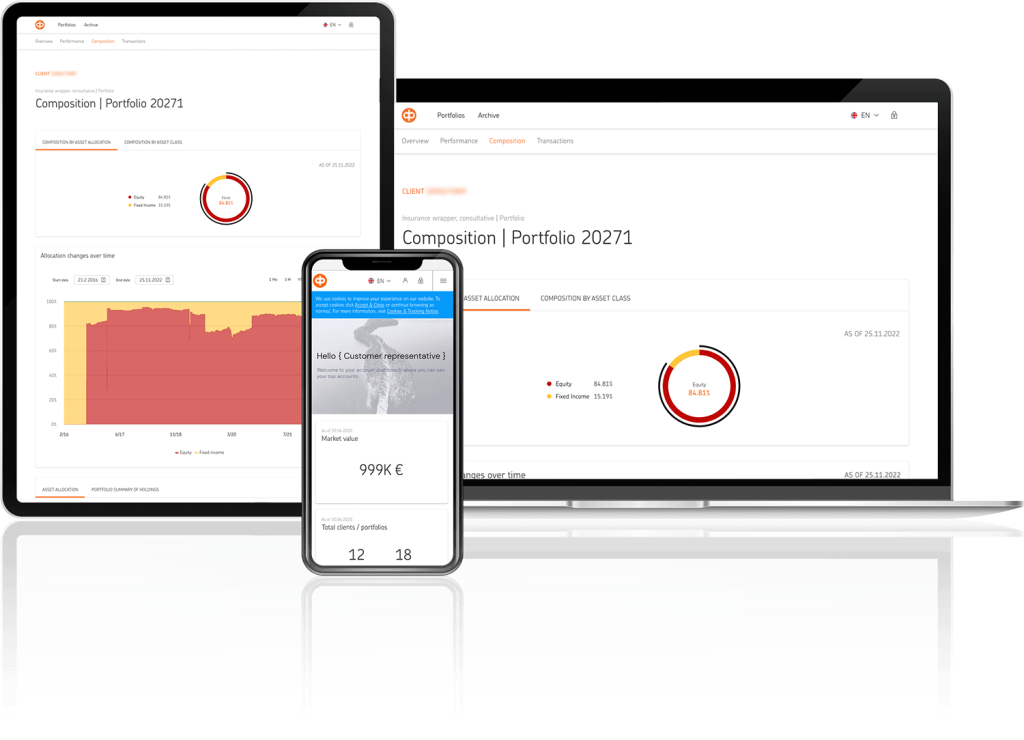

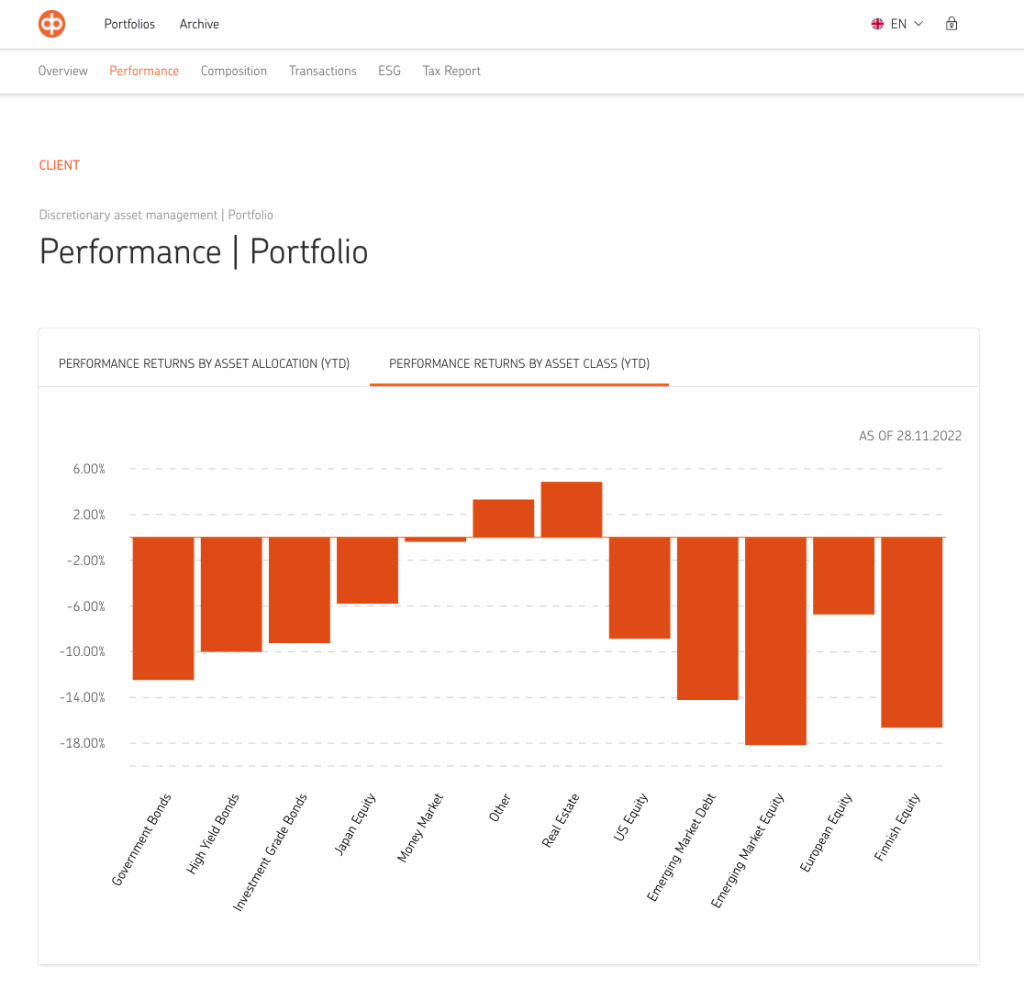

The portal caters to private wealth users needing 24/7 authorised access to performance, risk and allocation information for their family and business portfolios.

Alongside reporting to the portfolio owners, the portal also allows access to relevant client relationship managers and third-party providers to OP’s clients, such as accountants. Why? Because they too require in-depth portfolio data for the purposes of highly personalised services such as tax computations and filings.

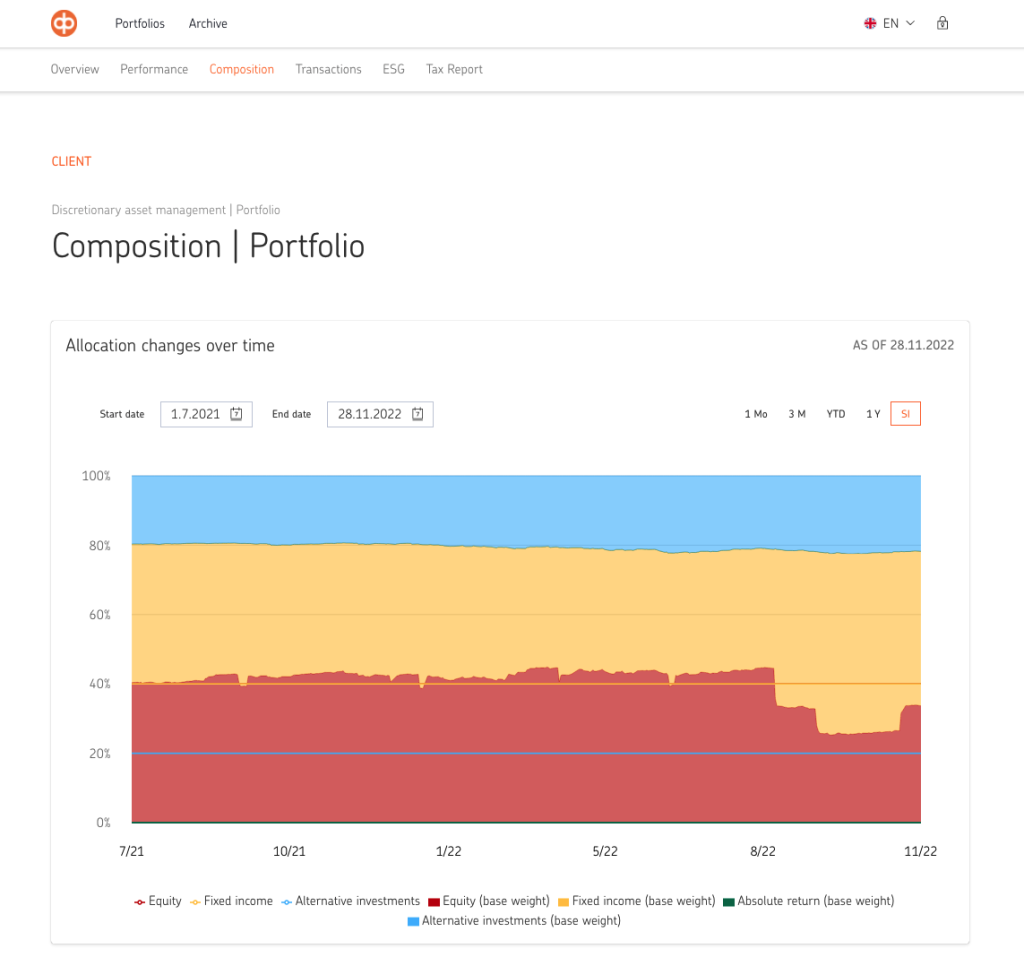

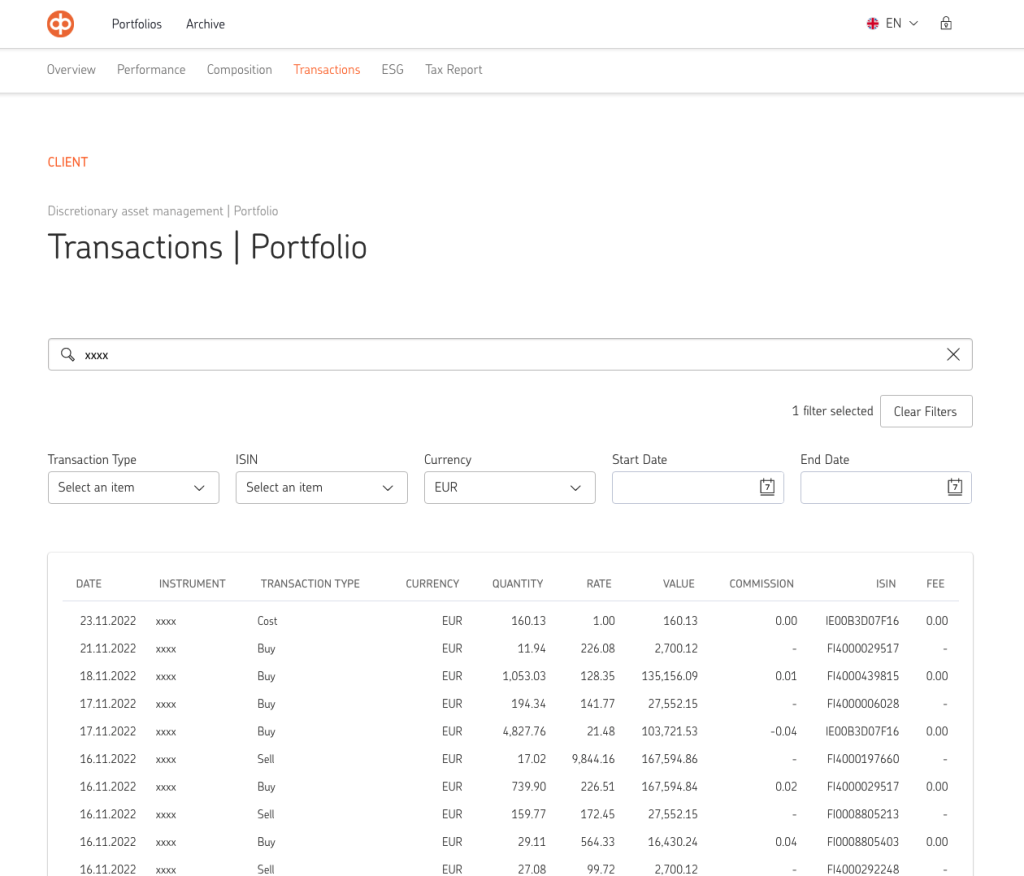

Every feature on the portal was designed with stellar client experience in mind. Users can log in and see their portfolios grouped by family and type, and view portfolio constituency through several user-driven settings. Clients are able to access summary overviews and breakdown further levels of attribution. All of the portal features are designed to ultimately navigate users to each individual transaction, enabling them to search and review any specific trades executed against the portfolio.

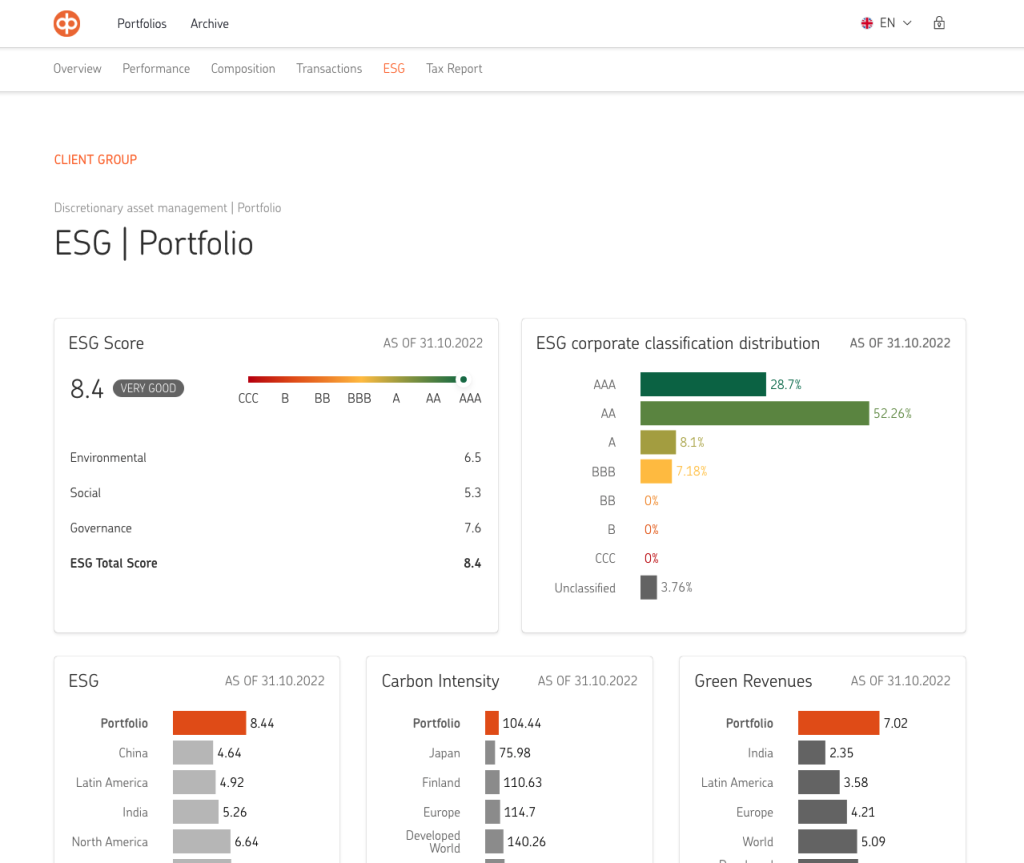

But that’s not all. ESG specific metrics can be viewed in easily discernible representations against each portfolio. Previously, this type of information would only be shared annually in paper form, at year end. Aggregating information in this way through a single portal strengthens the rationale and business case for OP’s commitment to their digital investment communications strategy.

Historically, the OP team would send out portfolio information using PDFs which were sent on a monthly, quarterly, and annual basis. Now, via the interactive portal, clients are able to view real-time valuation, holdings, and transactional data as well as historical views of the same information. Through interactive charting they are able to explore data and address questions they might have about their investments in a self-serve fashion.

Andrew Eames – Senior Product Manager, Kurtosys

The results

Since launch, feedback has been overwhelmingly positive, allowing OP to provide new options to clients and third parties that previously didn’t exist. It’s early days, but there’s a strong sentiment amongst OP and its clients that the client portal has taken investment communications into the digital age — providing a far more efficient way of distributing vital data. It’s also paved the way for clients to provide feedback to their relationship managers — input that’s crucial to the portal’s continued value. We are very proud at at the intuitive experience that is now available, given the complexity of the requirements.

Collaboration at the core

Clear communication is everything. The fact that the OP team had spent time discussing their ideas internally and producing an accompanying sitemap of what they believed the portal should look like, made this an easy to follow and informative brief. While initial component numbers required on the portal were high, these were refined and narrowed down to what the final user would likely want to see. The OP team ran each component through user groups, providing our team with useful feedback on what the user would understand based on the information shared and the way in which it was portrayed.

Who is OP Financial Group?

OP Financial Group is Finland’s largest financial services group with a mission to promote sustainable prosperity, security and wellbeing of their owner-customer and operating region. The Group’s vision is to be the leading and most appealing financial services group in Finland for their customers, employees, and partners. Together with their owner-customers, they have been building Finnish society and a sustainable future for 120 years now.

The feedback

Both clients and client managers have been pleased with the portal and we are providing flexibility to our clients that many others can’t. In Finland, we participate in a yearly independent survey for institutional clients that measures levels of service they are getting from their asset managers. We have just received the results and our reporting service has improved nicely from last year, showing that the new reporting service from Kurtosys has had a notable positive impact.

Tommi Sauramo – Head of Reporting, OP Asset Management, OP Financial Group

Kurtosys makes creating your investor portal pain-free. Create interactive investment dashboards, share privileged documents, surface gated insights, and expose your clients to sustainability related data. Integrate your portal into your existing ecosystem of digital tools such as Salesforce, Azure AD and Adobe. It’s everything at your clients’ fingertips — all in one place.

Find out more about our portals then let’s talk about a demo.